Discover Smart Investments With Oak Valley Capital.

Discover Smart Investments With Oak Valley Capital.

Discover Smart Investments With Oak Valley Capital.

Extraordinary partners delivering double-digit risk-adjusted returns through thoughtfully selected lower middle market acquisitions & operations.

Extraordinary partners delivering double-digit risk-adjusted returns through thoughtfully selected lower middle market acquisitions & operations.

Extraordinary partners delivering double-digit risk-adjusted returns through thoughtfully selected lower middle market acquisitions & operations.

0+ Yrs

0+ Yrs

Of combined executive experience

0+ Yrs

0+ Yrs

Of combined executive experience

0+ Yrs

0+ Yrs

Of combined executive experience

$0.0B

$0.0B

Cumulative transaction volume across leadership team

$0.0B

$0.0B

Cumulative transaction volume across leadership team

$0.0B

$0.0B

Cumulative transaction volume across leadership team

0.00x

0.00x

Average MOIC across porfolio

0.00x

0.00x

Average MOIC across porfolio

0.00x

0.00x

Average MOIC across porfolio

$0.0M

$0.0M

AUM

$0.0M

$0.0M

AUM

$0.0M

$0.0M

AUM

Alpha: Value creation through forced appreciation

Alpha: Value creation

through forced appreciation

Superior Risk-Adjusted Returns: Through Recession-Resistant Niches

Superior Risk-Adjusted Returns:

Through Recession-Resistant Niches

Proven track record: tenured sponsors & advisory board

Proven track record: tenured

sponsors & advisory board

Our Focus

LBOs

Criteria

Lower Middle Market | Commercial & Industrial M.E.P

Target Return

3.25x–4.75x MOIC

Hold Term

7–10 Years

Land Development

Criteria

Primary, Secondary & Select Tertiary Markets across AZ, NV, UT, & TX

Target Return

2.0x–4.5x MOIC

Hold Term

6–24 Months

LBOs

Criteria

Lower Middle Market | Commercial & Industrial M.E.P

Target Return

3.25x–4.75x MOIC

Hold Term

7–10 Years

Land Development

Criteria

Primary, Secondary & Select Tertiary Markets across AZ, NV, UT, & TX

Target Return

2.0x–4.5x MOIC

Hold Term

6–24 Months

Welcome To Oak Valley Capital

We are a private investment firm headquartered in Phoenix, AZ specializing in the acquisitions and operations of lower middle market, commercial and industrial MEP businesses across the U.S, as well as land development and advisory services for LMM to MM-sized companies. We operate as a fully integrated platform, managing the entire investment lifecycle – from deal sourcing and due diligence to post-acquisition operations, marketing, and exit.

Our executive team brings over five decades of experience and a consistent track record of delivering double-digit, risk-adjusted returns through disciplined market selection, rigorous due diligence, structured transactions, and robust post-close management.

We are committed to long-term equity growth for our investors. Backed by strong fundamentals and vertically integrated, locally based teams, we maintain full control and agility allowing us to stabilize and scale each business with precision. As a result, we are well-positioned to execute our business plan.

OVC offerings are limited to Accredited Investors (Rule 501(a), Regulation D) and Qualified Institutional Buyers (Rule 144A).

Welcome To Oak Valley Capital

We are a private investment firm headquartered in Phoenix, AZ specializing in the acquisitions and operations of lower middle market, commercial and industrial MEP businesses across the U.S, as well as land development and advisory services for LMM to MM-sized companies. We operate as a fully integrated platform, managing the entire investment lifecycle – from deal sourcing and due diligence to post-acquisition operations, marketing, and exit.

Our executive team brings over five decades of experience and a consistent track record of delivering double-digit, risk-adjusted returns through disciplined market selection, rigorous due diligence, structured transactions, and robust post-close management.

We are committed to long-term equity growth for our investors. Backed by strong fundamentals and vertically integrated, locally based teams, we maintain full control and agility allowing us to stabilize and scale each business with precision. As a result, we are well-positioned to execute our business plan.

OVC offerings are limited to Accredited Investors (Rule 501(a), Regulation D) and Qualified Institutional Buyers (Rule 144A).

Proud Member Of

Proud Member Of

Proud Member Of

Why Invest With Oak Valley Capital?

Why Invest With Oak Valley Capital?

Why Invest With Oak Valley Capital?

Access to Vetted, Institutional-Quality Investment Opportunities

Access to Vetted, Institutional-Quality Investment Opportunities

Access to Vetted, Institutional-Quality Investment Opportunities

Vertically Integrated Platform – Acquisitions, Operations, Sales & Marketing

Vertically Integrated Platform – Acquisitions, Operations, Sales & Marketing

Vertically Integrated Platform – Acquisitions, Operations, Sales & Marketing

Quarterly Distributions and Tax-Advantaged Structures

Quarterly Distributions and Tax-Advantaged Structures

Quarterly Distributions and Tax-Advantaged Structures

Conservative Underwriting with Downside Risk Protection

Conservative Underwriting with Downside Risk Protection

Conservative Underwriting with Downside Risk Protection

Recession-Resilient, Durable Asset Classes

Recession-Resilient, Durable Asset Classes

Recession-Resilient, Durable Asset Classes

Invest In Recession-Resistant Asset Classes

Invest In Recession-Resistant Asset Classes

Invest In Recession-Resistant Asset Classes

Sponsor Compensation Structured Around Investor Performance

Sponsor Compensation Structured Around Investor Performance

Sponsor Compensation Structured Around Investor Performance

Sponsor Co-Investment in Every Deal

Sponsor Co-Investment in Every Deal

Sponsor Co-Investment in Every Deal

Our Values

Integrity

Integrity

Excellence

Excellence

Commitment

Commitment

Stewardship

Commitment

Stewardship

Our Proven Process

Our Proven Process

01

Research & Identify

Our growing market-share through acquisitions (ownership), and strengthened relationships with brokers and investment bankers gives us access to data, both on- and off-market opportunities, and insights into competitor activity. An even greater advantage we have is our direct experience of ownership within our target markets which provides us with real-time data enabling us to continuously assess marketplace climate at a local and national level giving us otherwise unknown insight to underlying drivers of supply and demand volatility in these markets.

01

Research & Identify

Our growing market-share through acquisitions (ownership), and strengthened relationships with brokers and investment bankers gives us access to data, both on- and off-market opportunities, and insights into competitor activity. An even greater advantage we have is our direct experience of ownership within our target markets which provides us with real-time data enabling us to continuously assess marketplace climate at a local and national level giving us otherwise unknown insight to underlying drivers of supply and demand volatility in these markets.

01

Research & Identify

Our growing market-share through acquisitions (ownership), and strengthened relationships with brokers and investment bankers gives us access to data, both on- and off-market opportunities, and insights into competitor activity. An even greater advantage we have is our direct experience of ownership within our target markets which provides us with real-time data enabling us to continuously assess marketplace climate at a local and national level giving us otherwise unknown insight to underlying drivers of supply and demand volatility in these markets.

02

Analyze

Our team of analysts have decades of career experience underwriting and valuing institutional credit and small businesses. Each deal we pursue undergoes a multi-stage process of objective, qualitative, and quantitive analysis which allows us to determine whether or not submitting an LOI is the next appropriate step. Only after passing the preliminary vetting do we submit an IOI/LOI. Upon acceptance of IOI/LOI we enter into a formal Due Diligence (DD) period where the deal undergoes a rigorous analysis (QoE) – a deep vetting of the business’s and owner’s financial history, history of employee-ship, inspections, appraisals, and much more all occur. This ‘fine-tooth comb’ DD process allows us to ensure every aspect of the deal aligns with our quality standards of businesses we acquire.

02

Analyze

Our team of analysts have decades of career experience underwriting and valuing institutional credit and small businesses. Each deal we pursue undergoes a multi-stage process of objective, qualitative, and quantitive analysis which allows us to determine whether or not submitting an LOI is the next appropriate step. Only after passing the preliminary vetting do we submit an IOI/LOI. Upon acceptance of IOI/LOI we enter into a formal Due Diligence (DD) period where the deal undergoes a rigorous analysis (QoE) – a deep vetting of the business’s and owner’s financial history, history of employee-ship, inspections, appraisals, and much more all occur. This ‘fine-tooth comb’ DD process allows us to ensure every aspect of the deal aligns with our quality standards of businesses we acquire.

02

Analyze

Our team of analysts have decades of career experience underwriting and valuing institutional credit and small businesses. Each deal we pursue undergoes a multi-stage process of objective, qualitative, and quantitive analysis which allows us to determine whether or not submitting an LOI is the next appropriate step. Only after passing the preliminary vetting do we submit an IOI/LOI. Upon acceptance of IOI/LOI we enter into a formal Due Diligence (DD) period where the deal undergoes a rigorous analysis (QoE) – a deep vetting of the business’s and owner’s financial history, history of employee-ship, inspections, appraisals, and much more all occur. This ‘fine-tooth comb’ DD process allows us to ensure every aspect of the deal aligns with our quality standards of businesses we acquire.

03

Compete

SMB: Our vetting process and current ownership in the target markets we compete in provides credibility and confidence to the IB/Brokers and sellers involved usually giving us the advantage when competing in deals. Multifamily: Our in-house Director of Acquisitions leverages his network of institutional multifamily connections, along with the credibility he has built with the most active brokers in the state to negotiate on the company’s behalf.

03

Compete

SMB: Our vetting process and current ownership in the target markets we compete in provides credibility and confidence to the IB/Brokers and sellers involved usually giving us the advantage when competing in deals. Multifamily: Our in-house Director of Acquisitions leverages his network of institutional multifamily connections, along with the credibility he has built with the most active brokers in the state to negotiate on the company’s behalf.

03

Compete

SMB: Our vetting process and current ownership in the target markets we compete in provides credibility and confidence to the IB/Brokers and sellers involved usually giving us the advantage when competing in deals. Multifamily: Our in-house Director of Acquisitions leverages his network of institutional multifamily connections, along with the credibility he has built with the most active brokers in the state to negotiate on the company’s behalf.

04

Manage

We take pride in being fully vertically integrated across acquisitions and analysis, operations, sales and marketing, and accounting. Our hands-on operational approach enables us to identify and resolve issues swiftly and cost-effectively. Ultimately, maximizing value for our investors at every step for true value creation.

04

Manage

We take pride in being fully vertically integrated across acquisitions and analysis, operations, sales and marketing, and accounting. Our hands-on operational approach enables us to identify and resolve issues swiftly and cost-effectively. Ultimately, maximizing value for our investors at every step for true value creation.

04

Manage

We take pride in being fully vertically integrated across acquisitions and analysis, operations, sales and marketing, and accounting. Our hands-on operational approach enables us to identify and resolve issues swiftly and cost-effectively. Ultimately, maximizing value for our investors at every step for true value creation.

05

Distribute & Report

Our investor relations cadence includes quarterly distributions and comprehensive financial statements, supplemented by clear, concise monthly communications.

05

Distribute & Report

Our investor relations cadence includes quarterly distributions and comprehensive financial statements, supplemented by clear, concise monthly communications.

05

Distribute & Report

Our investor relations cadence includes quarterly distributions and comprehensive financial statements, supplemented by clear, concise monthly communications.

06

Capital Event & Reinvest

Capital events are contingent on, but not limited to, four main variables and are used as the framework when determining the exit strategies of any given asset class:

· Cash Flows & Market Demand

· Quality/Quantity of Debt & Equity

· Operational Efficiency

· Emerging Opportunities: i.e., shifts in market climate (demand of asset), 1031 exchange opportunities, etc.

A capital event may involve a complete sale of the asset or a refinance. In all cases, our priority is to ensure full repayment of investor capital and to meet or exceed projected returns upon completion of the event.

06

Capital Event & Reinvest

Capital events are contingent on, but not limited to, four main variables and are used as the framework when determining the exit strategies of any given asset class:

· Cash Flows & Market Demand

· Quality/Quantity of Debt & Equity

· Operational Efficiency

· Emerging Opportunities: i.e., shifts in market climate (demand of asset), 1031 exchange opportunities, etc.

A capital event may involve a complete sale of the asset or a refinance. In all cases, our priority is to ensure full repayment of investor capital and to meet or exceed projected returns upon completion of the event.

06

Capital Event & Reinvest

Capital events are contingent on, but not limited to, four main variables and are used as the framework when determining the exit strategies of any given asset class:

· Cash Flows & Market Demand

· Quality/Quantity of Debt & Equity

· Operational Efficiency

· Emerging Opportunities: i.e., shifts in market climate (demand of asset), 1031 exchange opportunities, etc.

A capital event may involve a complete sale of the asset or a refinance. In all cases, our priority is to ensure full repayment of investor capital and to meet or exceed projected returns upon completion of the event.

Leadership

Joe Luca

Founder & Managing Partner

Learn More

Joe Luca

Founder & Managing Partner

Learn More

Wayne Bell

Senior Operating Partner

Learn More

Wayne Bell

Senior Operating Partner

Learn More

Garrett Williams

Principal, Advisory Services

Learn More

Garrett Williams

Principal, Advisory Services

Learn More

Forrest Schwartz

Principal, Advisory Services

Learn More

Forrest Schwartz

Principal, Advisory Services

Learn More

Christian Trujillo

Operating Partner, Land Development

Learn More

Christian Trujillo

Operating Partner, Land Development

Learn More

Sammy Serwa

Chief Marketing Officer

Learn More

Sammy Serwa

Chief Marketing Officer

Learn More

Team

Bryan Junus | CFA

Sr. Investment Analyst

Learn More

Bryan Junus | CFA

Sr. Investment Analyst

Learn More

Keith Fernandez | MBA

Vice President of Investments

Learn More

Learn More

Slobodan Djukic

Investment Analyst III

Learn More

Slobodan Djukic

Investment Analyst III

Learn More

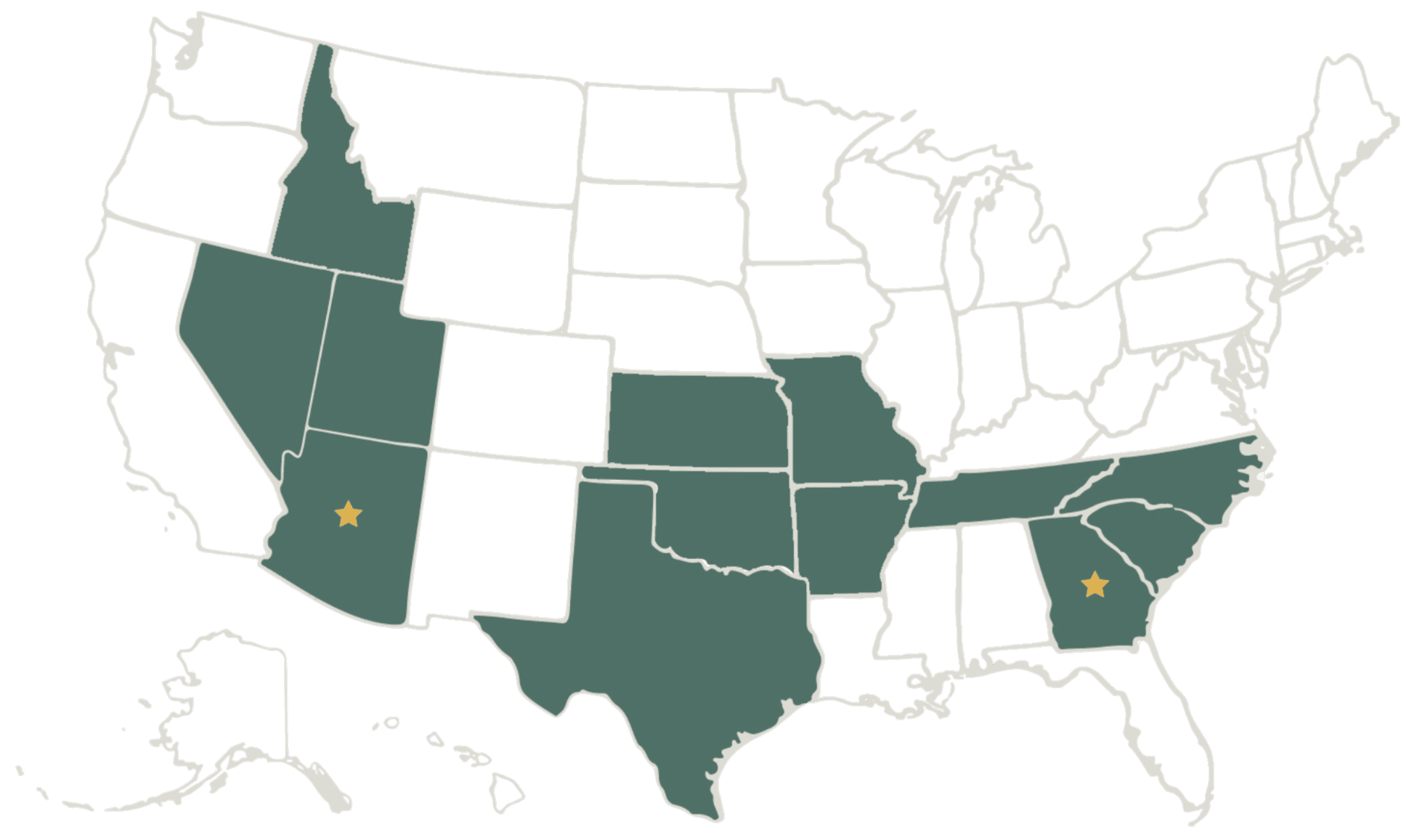

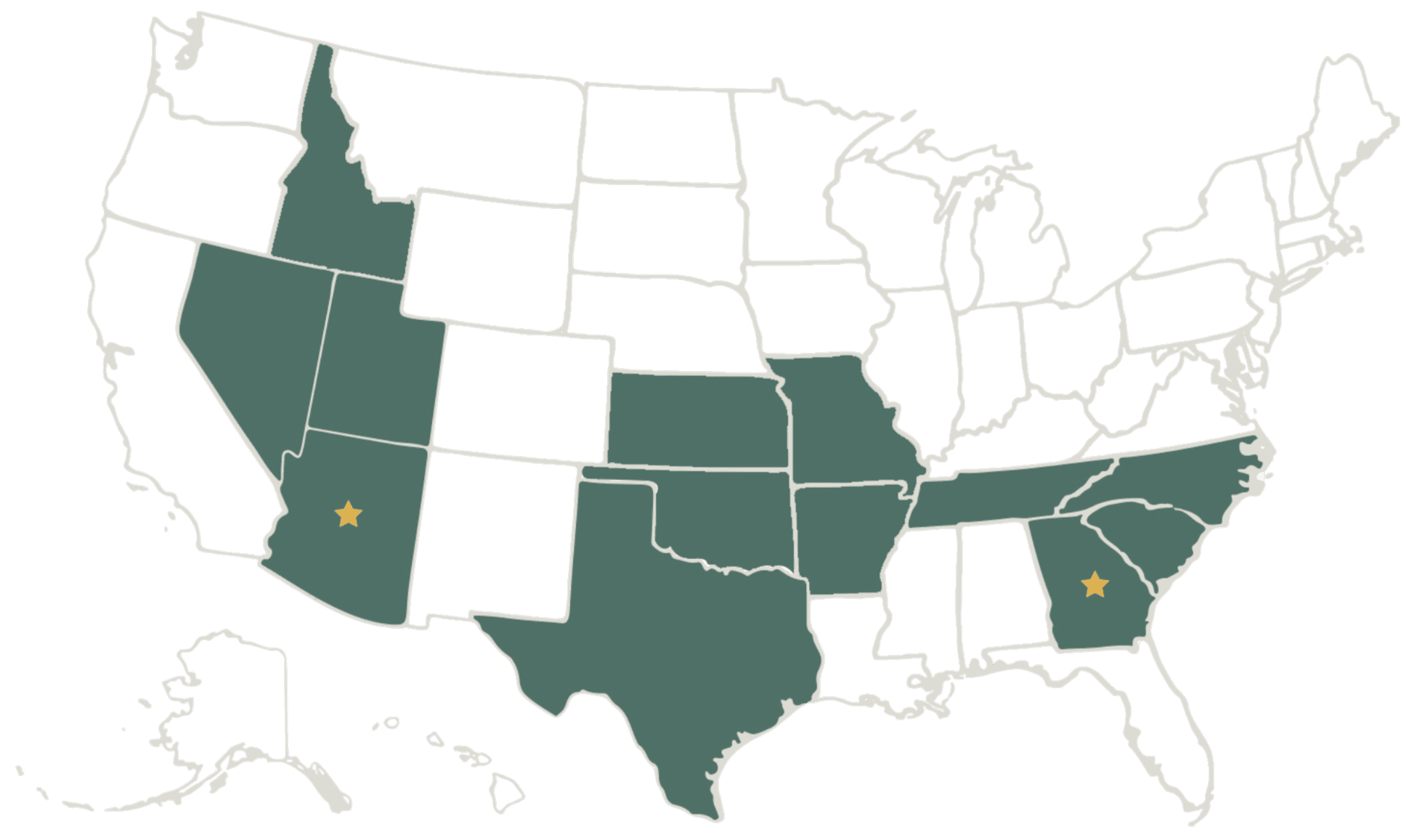

Target Markets

ARIZONA

UTAH

Texas

IDAHO

NEVADA

KANSAS

MISSOURI

ARKANSAS

OKLAHOMA

TENNESSEE

NORTH CAROLINA

SOUTH CAROLINA

GEORGIA

ARIZONA

UTAH

NEVADA

ARKANSAS

KANSAS

IDAHO

MISSOURI

TEXAS

OKLAHOMA

TENNESSEE

NORTH CAROLINA

SOUTH CAROLINA

GEORGIA

ARIZONA

UTAH

NEVADA

ARKANSAS

KANSAS

IDAHO

MISSOURI

TEXAS

OKLAHOMA

TENNESSEE

NORTH CAROLINA

SOUTH CAROLINA

GEORGIA

Portfolio

FAQs

What is Oak Valley Capital?

Who can invest with Oak Valley Capital?

Am I an accredited investor?

What is Oak Valley Capital?

Who can invest with Oak Valley Capital?

Am I an accredited investor?

What is Oak Valley Capital?

Who can invest with Oak Valley Capital?

Am I an accredited investor?

Schedule a Call

Discover Smart Investments With Oak Valley Capital

Schedule a Call

Discover Smart Investments With Oak Valley Capital

Schedule a Call

Discover Smart Investments With Oak Valley Capital